When I first visited Cambodia almost 15 years ago on a Humanitarian trip with a Christian NGO, the first thing I noticed upon touching down was how hot it was! When we went out to the rural countryside, we discovered that so many towns, villages and households did not have any form of electrical power at all. It immediately occurred to me that solar power could easily be generated and would be an easy solution to the lack of electricity in this country.

Today, based on energy research, it is without a doubt that Cambodia has great potential for solar power, given its high average of sun hours and solar irradiation per day. This equates to almost six peak sunlight hours a day, and an average solar irradiation of 5.0 kWh per square meter per day during the dry season. (Paul Millar, SEA Globe, October 31, 2019. Access here). As the world responds to the energy crisis created by global climate changes and oil shortages, the potential for the domestic use and commercialisation of solar power in Cambodia as a form of renewable energy has become even more acute and in demand.

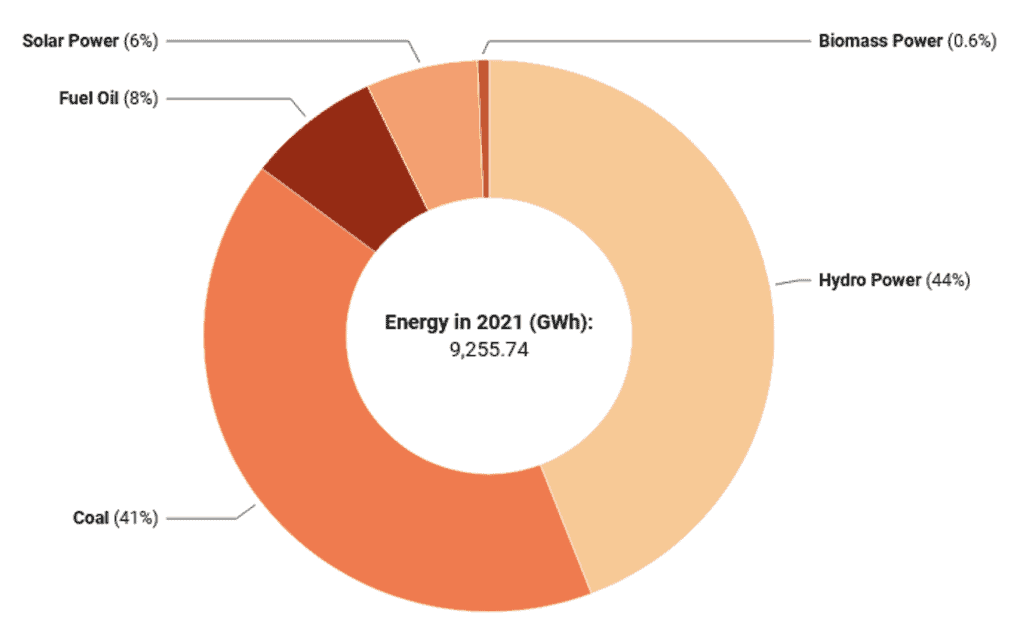

As of 2021, over 51% of the country’s domestic energy production come from renewable sources. The majority was sourced from hydropower (44.17%), while solar and biomass accounted for around 7%.

Cambodia’s Domestic Energy Supply

Source: Electricity Authority of Cambodia

The increased adoption of renewable energy in Cambodia is one of Southeast Asia’s success stories, particularly amongst the countries in ASEAN. Thanks to hydropower, Cambodia is in an exclusive club of countries that have a majority share of their energy consumption made up of renewable energy sources. Yet despite this success, many challenges remain.

Over the past 15 years, Cambodia has seen rapid population and economic growth and this had led to a tenfold increase in electricity demand. Despite its efforts to increase renewable energy supply the hard truth is it simply cannot meet the demands of the economy and people of the land. This has in fact been recently confirmed by the Ministry of Mines and Energy in its recent Power Development Plan of 2021.

It is no secret that the country’s electricity network lacks stability and often suffers from power cuts. This can be testified by domestic users and especially by the many hundreds of factories and industrial users. According to the Asian Development Bank (ADB), there has been a substantial lack of investment into the electricity infrastructure of the country, and this was clearly evident in the wide spread power cuts and outages in 2019 that cause a deficit of not less than 400 MW daily, lasting from two to five hours every day and this persisted for the entire hot season that year.

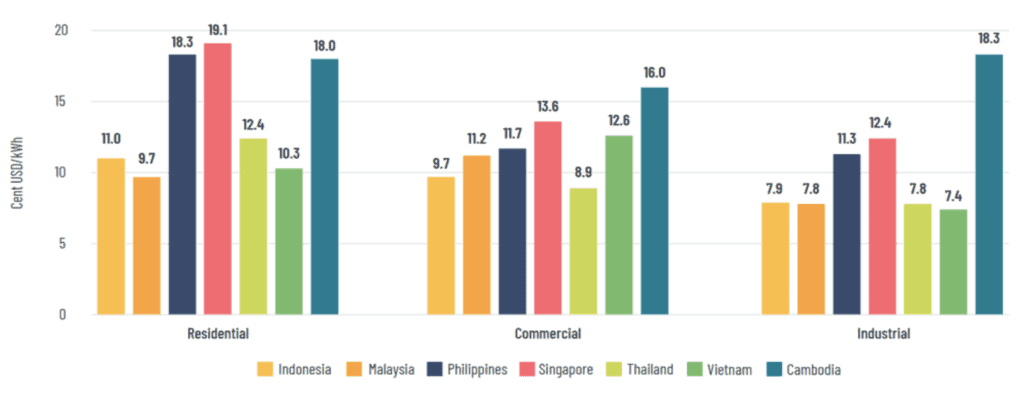

The cost of electricity is probably the biggest most critical factor. Cambodia suffers from high and often very volatile power costs. Electricity prices in 2020 reached their highest levels in the last 15 years. Overall, compared to its Southeast Asian neighbours, the county’s electricity tariffs are significantly higher and this creates a huge deterrent when companies are deciding where to set up their factories.

Power Tariffs in Major Southeast Asian Economies 2019

Source: Climate Investment Funds citing ESDM, EIA

There is a lack of regulations specific to renewable energy in Cambodia. This means that in general, with the notable exception of solar power, renewable energy producers are dealt with in the same way as those that produce non-renewable power.

The regulatory framework for the energy sector in Cambodia is found in the Electricity Law of 2001, and this sets up two government entities – the Ministry of Mines and Energy (MME) and the Electricity Authority of Cambodia (EAC). The MME has a broad role of setting and administering government policies, strategies and planning in the power sector. The EAC is the essentially the utility board focused on the provision of electricity to the entire country. More importantly, the EAC is responsible for issuing licenses for the supply of electricity and setting tariff rates.

In addition, the Ministry of Environment is responsible for regulating environmental issues, including any environmental impact arising from all types of energy projects. In relation to investment, economic and financial incentives, the Council for the Development of Cambodia plays a key role in granting investment incentives to all types of energy projects, and in particular in recent times for projects related to “green energy”.

Despite the above challenges, there is now a light at the end of the tunnel. In recent times, the government has moved in tandem with global trends to construct and commission new large-scale solar power projects, functioning as power plants, in an effort to diversify Cambodia’s energy portfolio and to include more renewables. In conjunction with these initiatives, the government enacted the Solar Regulations 2018 and updated the applicable electricity tariffs, resulting in many companies exploring the possibilities of rooftop solar power for industrial use.

More significantly, the government relaxed restrictions on consumer use of grid-connected solar systems, through the 2020 Tariff and the 2021 Tariff. Previously, the Solar Regulations limited grid-connected rooftop solar to big and bulk consumers only. Under the 2021 Tariff, certain categories of medium consumers (i.e., industry, agriculture & trade) were also allowed to use grid-connected solar systems and produce solar energy for their own consumption.

This has resulted in a huge boost to the industrial sector, in particular the garment industry (which is the third largest industry in Cambodia) and to companies operating in special economic zones. This is because many factories have vast empty roof space that is not fully utilised, and no land acquisition or lease is required to install the solar systems.

Residential users however are still not permitted to be connected to the grid while using solar power.

A. New Investment Law

Cambodia enacted a new Law on Investment (LOI) in October 2021, and it focuses on renewable energy as one of the sectors to be incentivised. It provides additional tax incentives for green energy producers by registering as Qualified Investment Projects (QIPSs). The Law offers different options of basic incentives, but the most commonly used ones are:

In addition, there are a host of other incentives: including exemptions for Prepayment Tax, Minimum Tax, Export Tax, and a deduction of one hundred and fifty (150) percent from the tax base to activities such as research and development, human resource development and the construction of facilities for employees such as accommodation, canteens, and nurseries.

Whilst some of the practicalities of the new LOI are to be clarified in further Sub-Decrees, these tax incentives are quite forward thinking and should provide quite an attractive environment for renewable energy producers in Cambodia.

B. New Draft Environmental Code

The Environmental Code of Cambodia is presently being reviewed by the government. It has gone through many changes but.once promulgated, it should provide much needed clarity and certainty for green energy producers. Potentially, these include the following:

However, when that will be is unknown and the momentum for the legislation seems to have stalled somewhat.

In light of Cambodia’s improving framework for solar energy, it is no surprise to see more international and regional players eyeing Cambodia as the next solar destination, either to invest in existing projects or to set up their own projects. In addition, it is predicted that the adoption of the new Investment Law incentives and clarity from the Environmental Code and its implementation regulations will be a strong catalyst for further for investment into renewable energy in this Kingdom of Wonders.

Liow Yee Kai

Partner (Foreign Lawyer)

RHTLaw Asia

yeekai.liow@rhtlawasia.com

+65 6381 6834

Yee Kai is a foreign lawyer with RHTLaw Asia with over 15 years of corporate and commercial legal experience within the Corporate & Capital Markets practice areas in Hong Kong, New Zealand, and Singapore. He is also Of Counsel at RHTLaw Cambodia, a member of the ASEAN Plus Group.

RHTLaw Asia is a member of ONERHT, an integrated network of multidisciplinary professional and specialist services which empowers stakeholders to achieve purposeful growth.

© 2024 RHTLaw Asia LLP. All Rights Reserved.

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |