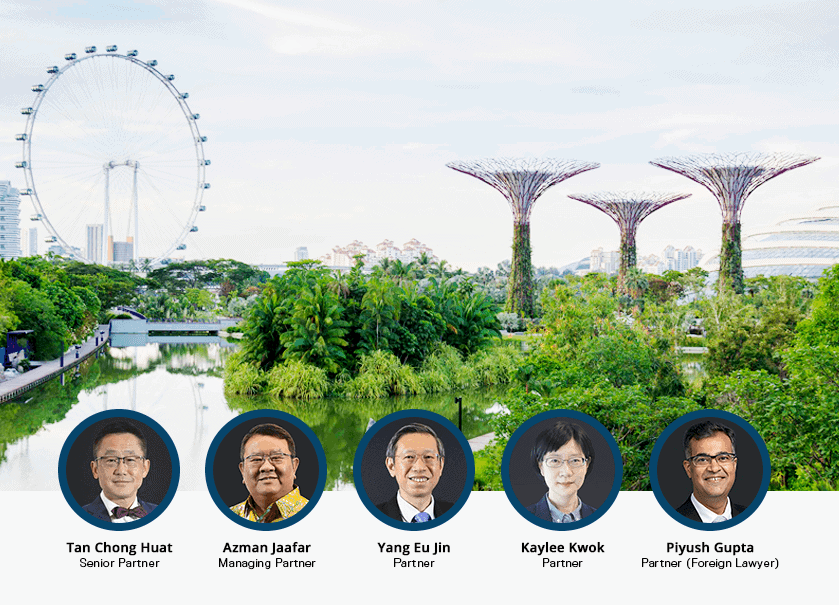

RHTLaw Asia’s newly launched ESG practice aims to equip clients with the right advice and knowledge to navigate ESG considerations and regulatory requirements as well as compete in Singapore’s Green Economy. Partners Azman Jaafar, Yang Eu Jin, Piyush Gupta, Kaylee Kwok and Tan Chong Huat bring their deep expertise across industries to the new practice.

The fallout of the pandemic has given businesses a chance to reassess almost every aspect of their operations. Consequently, ESG compliance has intensified in the wake of COVID-19 as governments are now committed to a green recovery.

ESG is not just about how a company is doing financially, but also considers how a company is run, how it serves the society, how it impacts the environment and how all of these factors need to be considered cumulatively to determine its overall performance.

Going forward, corporate decisions (especially those relating to M&A and investment related activities) will not be purely based on backward-looking “historical” data, but will require a more forward-looking, dynamic approach focusing on ESG-related risks and opportunities.

– Piyush Gupta, Partner (Foreign Lawyer) and Head of RHTLaw Asia’s Transportation & Logistics Industry Group

Sustainability is not the future of practice but it is about our future on this planet. What makes this challenging for businesses is the ingrained methods of old that tend to choose business efficacy over conservation, the environment, the community and good governance.

In our role as trusted advisors, we are the voice of reason to many who will listen to us. I suppose our role has come a full circle: from being purely transactional, we now have to be that beacon that will guide and counsel our clients on the requirements of tomorrow’s corporate citizenry. This will be a long conversation for many; and a long journey that will see businesses transform for the greater good. I see ourselves as part of the solution.

– Azman Jaafar, Managing Partner

General counsels, in-house legal advisers and external lawyers (collectively, the “Legal Team”) have always played an important role in managing environmental, social and governance (“ESG”) issues for organisations. However, as organisations increase their commitment to ESG standards in response to the COVID-19 pandemic, the acceleration of ESG regulations and heightened attention from regulators, consumers and other stakeholders, the Legal Team should no longer be just reacting to ESG issues and challenges, but should proactively become more involved in promoting, upholding and integrating ESG standards and opportunities within and amongst the organisations.

The Legal Team’s role is multi-pronged and this includes: setting the strategic direction for sustainability and responsible business; integrating ESG criteria into board and management decision-making and adopting ESG due diligence strategies for corporate transactions such as mergers & acquisitions or financing; ensuring transparency in reporting and disclosure of ESG compliance and, drafting and implementing robust ESG policies and procedures.

– Kaylee Kwok, Partner and and Co-Head of RHTLaw Asia’s Private Wealth (Investments, Estate Planning and Tax Solutions) Industry Group

At present, there is no overarching regulatory framework in Singapore pertaining to ESG. Instead, Singapore has a mix of regulations targeted at specific types of companies and/or industries. For example, all companies listed on the Singapore Exchange are required to prepare a sustainability report on a yearly basis. Listed companies are also subject to the Code of Corporate Governance 2018 setting out the corporate governance principles to be adhered to, which include the need to consider and balance the needs and interests of material stakeholders and to disclose in the companies’ annual reports their strategy for managing stakeholder relationships.

As a business-friendly jurisdiction, Singapore leans towards an incentive-based regulatory framework as opposed to a prescriptive approach to regulate ESG matters. For instance, the Monetary Authority of Singapore has recently set out a Green Finance Action Plan to encourage sustainable and green financing in Singapore; part of this plan involves the development of environmental risk management guidelines across banking, insurance and asset management sectors and to expand the ecosystem of external reviewers and rating agencies. The action plan also consists of grant schemes designed to defray costs and increase the availability of green loans and sustainability-linked loans for corporates. The underlying rationale here seems to be to create market incentives for corporates to adopt ESG-compliant behaviour, while at the same time assisting financial institutions to build competencies in relation to ESG practices.

– Yang Eu Jin, Partner and Co-Head of RHTLaw Asia’s Corporate and Capital Markets Practice and Head of the Education Industry Group

Simply put, the stages in the green journey will likely be 1) to know your carbon footprint, 2) take the necessary steps to decarbonise and 3) work towards net zero carbon emission. The first and most important step in my humble opinion, is to have the board and senior management resolve its commitment to sustainability, as well as to garner the support of its shareholders, employees and stakeholders for such commitment.

Depending on the level and extent of commitment agreed and set by the board and senior management (which should be realistic relative to its resources and with respect to the various milestones and timelines), the same may then be publicised, socialised and institutionalised in its operational, business and financial processes.

Nevertheless, the challenges of economic realities and pressing commercial responses will relentlessly push and test such commitment to its limit. Hence the first step to build and establish the resolve of the board and senior management cannot be underestimated, and its green journey will invariably falter without the support of its shareholders, employees and other stakeholders.

– Tan Chong Huat, Senior Partner

RHTLaw Asia is a member of ONERHT, an integrated network of multidisciplinary professional and specialist services which empowers stakeholders to achieve purposeful growth.

© 2024 RHTLaw Asia LLP. All Rights Reserved.

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |